Goldman Sucks! Exposing the toxic culture of investment banking

The investment banking industry is notorious for its harsh working conditions. Will a recent revelatory employee report change anything?

“I would get ulcers from not enough sleep,” says Edward*, frankly. “I worked for months where Monday to Thursday I would not have left the office before midnight. Most of the work comes in at the end of the day once the senior members of the team finally review the document for a client presentation the next morning. You then have overnight to make the updates — we’d often be completing presentations at 2am.”

Edward is now 28, and working in private equity. But, back in those ulcerous days, he was working as an analyst at a bulge bracket investment bank. And, unfortunately, those long hours and steep expectations are still seen as the norm in the investment banking industry. “This attitude to working hours is simply reality in many investment banking teams,” he explains. “The hours are famously tough [and] mistakes are not tolerated. You have to maintain an impeccable level of detail, even if it’s 4am in the morning.”

"We’d often be completing presentations at 2am..."

If you’ve already worked a full day (and have another full day to look forward to tomorrow), it seems unreasonable to have meticulous precision expected of you at 4am in the morning. After all, we live in a world where ‘sleep-hygiene’ is the latest wellbeing buzzword. We’re all supposed to be getting a solid eight hours a night; abandoning our screens at least two hours before we turn in. Hell, we’re meant to throw our iPads and smartphones into another room before we go to sleep; curled up in utter darkness and so completely turned off that spreadsheets and stocks can’t even find us in our dreams.

But the ‘sleep hygiene’ phenomenon hasn’t yet penetrated the thick, institutionalised walls of many investment banks. Edward and his ulcers are, unfortunately, right. And never has this sorry state of affairs been more apparent than this year, when a presentation compiled by 13 US employees of Goldman Sachs brought the company’s callous working conditions into a stark, excruciating focus.

It’s safe to say that Goldman Sachs already had a reputation. Who could forget that gloriously visceral nickname coined by Rolling Stone’s Matt Taibbi? For those who have, Taibbi called Goldman “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

Shudder. But it’s an apt, if visceral description. If investment banks are known for unforgiving hours, extortionate expectations and a tough workplace culture, then Goldman Sachs has become the biggest bully in the financial playground.

Charlotte*, 27, can attest first-hand to the vampire squid’s dubious workplace practices, having worked there only a few years ago. “I don’t think it’s any secret the hours are hard,” she says. “I loved my team and the work I was doing — but the hours were not sustainable. I loathed paying rent for a flat I basically wasn’t living in.”

But, while the investment bank’s reputation may have preceded it, the recent dossier — shown to bosses in February, and made public last week — exceeded even the weariest, most cynical expectations.

It revealed that first year analysts were working an average of 95 hours per week, and sleeping for just five hours per night. It disclosed that the majority of first year analysts felt as though they’d fallen victim to workplace abuse. And some of the personal anecdotes are horrifying.

“Being unemployed is less frightening to me than what my body might succumb to if I keep up this lifestyle,” said one participant. Another added that: “My body physically hurts all the time and mentally I’m in a really dark place.”

“I’ve been through foster care and this, arguably, is worse,” said a third.

"Mentally, I’m in a really dark place..."

Shocking though the report is, this isn’t the first time the brutal working conditions of Goldman Sachs have been brought to the public’s attention. In 2015, US analyst Sarvshreshth Gupta tragically took his own life after speaking out over severe sleep deprivation and overwork.

But Gupta’s story, coupled with those of Edward, Charlotte and those who compiled the recent employee presentation, begs the question: What will it take for this madness to end? When will these companies curb their untenable working conditions, and instead decide to prioritise the safeguarding of their employees’ mental and physical health over profit?

But there may be a light at the end of the tunnel. There’s a sense that we’re almost at a watershed moment for these fast-paced, wholly flawed workplaces. Generation Z appears to be putting its collective foot down, stating — in no uncertain terms — that they simply won’t work to the archaic, inhumane rules created (and accepted) by previous generations.

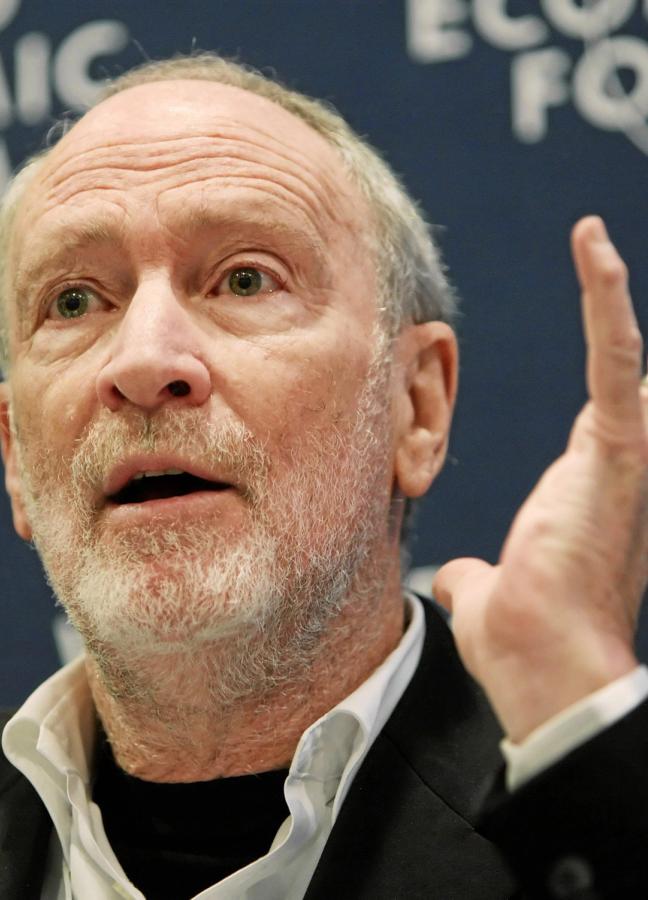

This is the view of Professor Sir Cary Cooper, CBE: Professor of Organisational Psychology and Health at Manchester Business School, and co-founder of the National Forum for Health and Wellbeing at Work.

“The Goldman Sachs model is going,” Cooper tells Gentleman’s Journal. “Going big time. [Because] they’ll lose people. That old-fashioned, ‘you have to work 80 hours a week in order to demonstrate commitment’ [culture] is gone.”

Cooper is adamant that this shift in workplace culture starts with the younger generations. “The interesting thing is, that’s the generation called snowflakes. And why are they called snowflakes? They’re called snowflakes because they’re not prepared to tolerate what their parents were prepared to tolerate in the workplace — i.e., a punitive, long hours culture. That’s not the culture they want — and they leave.”

Professor Sir Cary Cooper

It’s true. There is a growing sense among those entering the workforce that 95-hour weeks — such as those described in the Goldman Sachs employee presentation — are simply unacceptable. And it is this staunch refusal of such an imbalanced work-life balance that will herald a sea change for investment bank culture (or, indeed, any culture that places such demands on its employees).

“The [e.g.] 100 hours might be spent in the office, or at your desk, but it’s rarely doing actual work at full speed,” Edward points out. Charlotte agrees: “If you are working 100 hours, you are not working to the best of your ability,” she says. “It’s just not possible to be motivated for all of that time — and that means you’re not going to be producing your best work.”

Cooper’s opinion on these 95-100 hour week is similarly critical. “I don’t understand an organisation that would work people 80 or 100 hours per week,” he admits. “All you have to say to a managing director is: would you like to fly in a plane with someone who’s in his 100th hour? Would you like a surgeon to operate on your heart in his 100th hour?”

“Would you like a surgeon to operate on your heart in his 100th hour?"

Awareness, then, is growing. Millennials and Gen Zs are increasingly waking up to the fact that there are other jobs they may enjoy — and that can even pay as handsomely as careers in investment banking.

“If I was graduating today, I wouldn’t do it,” admits Edward. “I’d go into a growing tech start-up. I know 21 year olds sitting on $2M+ of equity who just joined a unicorn at the right time. Amusingly, many of these people tried and failed to get into banking when they graduated — but they’re now in a much better position.”

“But not all investment banks behave in this way,” Cooper points out. “If you look at some banks like Barclays, Lloyds — they are much more people-friendly. They’re building wellbeing policies, they’re trying to control excessive emails, they’re trying to control the hours of work. So no, it’s not endemic to investment banks.”

It’s good to hear. Because, the recent report paints a pretty bleak picture of the investment banking industry. But the report itself is even getting some tangible results. Goldman Sachs CEO David Solomon responded to the Goldman Sachs employee presentation, stating that it is something he and his leadership team are taking “very seriously”. The company has even pledged to enforce its previously paper-thin ‘no work on Saturday’ rule.

And, although the toxic workplace culture certainly isn’t endemic to all investment banks, the case remains that any struggling employees is still too many. But the question remains: will this culture change now, for good? Has the Goldman Sachs employee presentation triggered a permanent shift in investment bank workplace values, and the demands placed on their employees?

It’s a question that only the future can answer. But, as far as Cooper’s concerned, change across all workplace cultures is fast approaching.

“In 2015, we started the National Forum for Health and Wellbeing at Work,” he says. “Now, we have 40 members. Microsoft, BP, Shell, BT — and they employ millions of people. It’s big. Big private, big public sector bodies. And they’re all saying the same thing: we have to change the culture.”

*Names have been changed to protect anonymity.

Looking for a happier business tale? Here is the story of two who became multi-billionaires by 30…

Become a Gentleman’s Journal member. Find out more here.

Become a Gentleman’s Journal Member?

Like the Gentleman’s Journal? Why not join the Clubhouse, a special kind of private club where members receive offers and experiences from hand-picked, premium brands. You will also receive invites to exclusive events, the quarterly print magazine delivered directly to your door and your own membership card.